Credit cards are not a new concept to the Indian consumers. There are over 2 crore credit card users in India. The total number of credit card transactions via ATMs is 517198 and at POS terminals the number is 68920504, as per RBI statistics for October 2015. Credit card transactions have grown at a CAGR of 21.3 %. The so called plastic money allows quick payment and paperless transactions. And with the current ecommerce wave plus the availability of internet to the rural market, the use of credit cards and net banking has shot up.

But as we very well know, with all that is good there is bad lurking around. The rising use of credit cards has also increased the rate of fraud in the country. In Mumbai itself, the first quarter of 2015 accounted a 90% increase in credit card and debit card fraud. To reduce these statics the government, banks and card issuing companies are taking numerous steps. However, these are all in light of protecting the consumer. Regular text messages, emails and advertisements flash on our screens to remind us about maintaining the privacy of our credit card details. So who is looking out for the sellers?

Cash payments are still common at physical stores. When it comes to online trade, credit card and internet transfers are popular. And since Indian ecommerce hasn’t yet reached its full potential the issues of the tiny online selling community are left unheard. Any online seller can become a victim of credit card fraud if they aren’t aware of fraudulent buyers. Planning on scrapping this payment option altogether? Not a good idea! Reducing payment options will drive customers in the direction of your competitors.

Battling Credit Card Fraud

-

Get your security in place

Use technology to your advantage. There are numerous fraud detection software available to online merchants. These can be used to identify bad buyers and reduce credit card chargebacks. Also make sure the payment gateways you use are secure for you and the buyer. Ecommerce expert Browntape assists online sellers with remittance and reconciliation, so you can concentrate on the important bits for successful online sales. Make the best of the resources available to you.

-

Ask shoppers to sign in

Request consumers to sign in to purchase your products. This gives you the chance to ask them for more information. Most fraudsters do not sign up and if they do all they have is fake information. Customer accounts allow your processing team and your site’s security software dig out potential fraudsters. This gives you the chance to nip it right in the bud. All marketplace platforms require consumers to sign in before making a purchase. This is a good first line of defense.

-

Dissimilar addresses

Check out the IP address to make sure it matches the credit card address so you know they both originate from the same location. In the event of fraud both addresses will differ. But there is also the possibility of the buyer being away from home. In which case, you can request for more information to make sure it is an authentic buyer placing the order. Watch expedited shipping like a hawk too! If the shipping address differs from the billing address be on your guard. Even if the credit card address does not match the shipping address, you could be at risk. Some buyers may be sending gifts to a friend or family member. But why would you risk it? Call up the buyer to confirm the purchase. It gives you the chance to match their phone number too.

-

Investigate when suspicious

Don’t hold back when you find something like an email address suspicious. Normally people don’t create email ids like xprn847201@gmail.com. If you notice such an anonymous email id take some time to check it out. When you notice multiple email addresses like these you are being scammed by the buyer. The same goes for the buyer’s physical addresses. Get software that can determine whether or not the given address is real or made up. Your payment software should be able to help you with this.

-

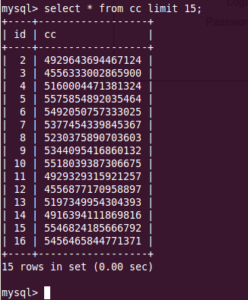

Maintain a credit card number log

By recording the credit card number it is easy for you to detect whether or not the buyer is using the same card or different ones. A scammer will use multiple. If you notice the customer uses more than three credit cards, it’s a red flag. Verify the consumer’s identity and confirm the fact that he or she indeed has all of the mentioned credit cards under their name. Take it a step further and contact their bank to clear your doubts.

-

Limit credit card declines

The credit card holder will know their pin, but a scammer won’t. So they will try as many times as possible. By restricting the number of times they can enter their credit card pin you limit their chances of committing fraud. After 3 attempts ban the consumer from your site. You can also ask for the credit card security code among other details. It is difficult to copy unless the scammer has the card in his hands.

-

Make them sign for the package

All the ecommerce marketplaces like Flipkart, Amazon and Snapdeal make their consumers sign for their packages. The signature can be later compared to previous purchases. In case a buyer refuses to sign for the package cancel the order and retrieve the product. Also, make it clear that you will only deliver products to a physical address. No drop offs!

Have you ever had an experience with fraudulent buyers? Let us know. To learn more about ecommerce, get in touch with Browntape. We are India’s leading e-commerce solutions experts and we are always happy to help!