Are you sure you are receiving the right amount due to you from marketplaces? Are you sure you are recording all your orders and corresponding payments? Are you paying extra tax? Are you making enough profit? If not, do you know where you need to optimise and where you need to cut down?

If you are plagued with the above questions and more, you need to get your payment reconciliation process automated right away! Read on to find out why.

Although ecommerce as a business channel is relatively new and evolving, the metrics remain the same as that of any other business. Each activity needs to be recorded, analysed and interpreted at periodic intervals, to reap benefits/profits.

That’s why accounting is an essential part of any business. Accounting is the process of recording, summarizing, analyzing and recording of financial transactions of an enterprise. A key aspect to determine the financial health is payment reconciliation, i.e. using two sets of records to ensure figures are accurate and in agreement, thus arriving at the profit/loss figures.

Just like technology revolutionized many an aspect of conducting business, books and registers used for maintaining accounts gave way to computer software like Tally, Quickbooks etc. for payment reconciliation.

Marketplace payment reconciliation – it’s not easy

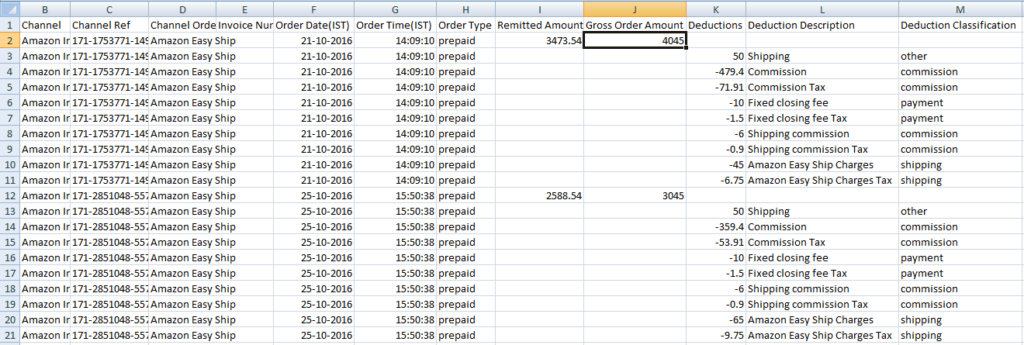

Functioning in a marketplace requires a systematic approach on all operational levels. Periodic analysis of each step and payment reconciliation have to be an active part of ecommerce operations. Be it through a single spreadsheet or an advanced ERP system, every marketplace seller must keep detailed data of order transactions to ensure profitability and identify areas of improvement.

Here’s why payment reconciliation can be complicated in the world of online marketplaces:

- It is complicated and tedious, especially in the case of high sales volume

- The ever-expanding list of fees and charges like service tax, listing fee, fulfilment fee, logistics fee etc. need to be kept track of, as they are subject to change any time

- The rate card vaires from one product category to another, and from one marketplace to another

- Lack of transparency on marketplace’s end with unfair/wrong penalties thrown in

- 2-3 months product returns window period after collecting from buyers

- Frequent policy changes

- General disregard for sellers’ payments across all levels of ecommerce companies

Automating payment reconciliation is important. Period!

In today’s world of million sellers vying for the same buyers’ attention, you need meaningful and accurate reconciliation reports to make informed decisions about inventory, pricing and discounting.

Many enterprises that use exhaustive ERP systems like Quickbooks, Tally and Oracle APPS need Accounts Receivable or Settlement reports to adjust Sales book entries for orders shipped to customers. Currently, these sellers close their accounting books by manually adding Shipping Costs, Warehousing costs and other logistics charges as miscellaneous expense in their ERP. This not only hampers their ecommerce business, but also becomes a loss centre in many cases.

By automating marketplace account reconciliations, you get the following benefits:

1. Reduce loss due to returns

No doubt, returns are a troubling aspect of ecommerce. With multiple policies, keeping track of returns and associated charges becomes a herculean task. However, with advanced dashboards and reports, you can channelise tracking of instances like below:

- Marketplaces don’t charge sales commission for returned products.

- Sellers can claim refund from marketplaces under seller protection plan if they receive a damaged return from logistics partner.

- Sometimes, customer asks for a return after remittance for the same is received by seller. In this case the marketplace deducts money from the next remittance cycle.

2. Estimate cost of investment in each marketplace

A business is profitable only when your returns are higher than what you have shelled out from your end. Obviously, even the ecommerce channel will take time to generate returns. But with varying payment cycles of marketplaces, it becomes all the more essential to know you are getting the worth of what you are spending. For example, sellers are part of promotional campaings run by marketplaces. So an analysis of the remittance report will show the remitted amount to be less that the selling price of the goods sold. With a reconciliation software, you know of the amount stuck in each remittance cycle.

3. Pay Tax Liabilities on time

Tax liabilities can be calculated based on the invoice sent by marketplaces. These tax invoices are generated at the end of the month or sometimes at the end of the quarter. The same TDS for the invoices need to paid to the tax authority before the 6th of every month. A reconciliation report should always show the amount to be refunded back to the seller, in case the seller claims for a refund.

How can Browntape online sellers in dealing with this nightmare?

Browntape payment reconciliation reports help an enterprise to:

-

stay on top on the company’s most valuable asset – CASH!

-

manage partial reconciliations and keep invoices open in ERPs.

-

create custom reports based on each ERP data set requirement and add whatever extra fields the seller needs.

-

check all the cost centres such as transportation costs, costs of promotional events, seller discounts, warehousing costs etc and post these cost incurred in their particular accounting ledgers in SAP ( with Browntape’s CO-PA settlement report).

Browntape’s suite of ecommerce products and services are designed to help marketplace sellers to manage Orders, Inventory and Reconciliation seamlessly. With its readily available Application Programming Interfaces (API) for Sales Order Reconciliation with marketplaces like Amazon, Flipkart, Snapdeal, and accounting systems like Tally and Quickbooks, Browntape can help large ecommerce sellers venture into online space without disrupting their existing lines of business.